Overcoming financial fears: improve your relationship with money

Learn how to face your financial fears head-on and improve your relationship with money...

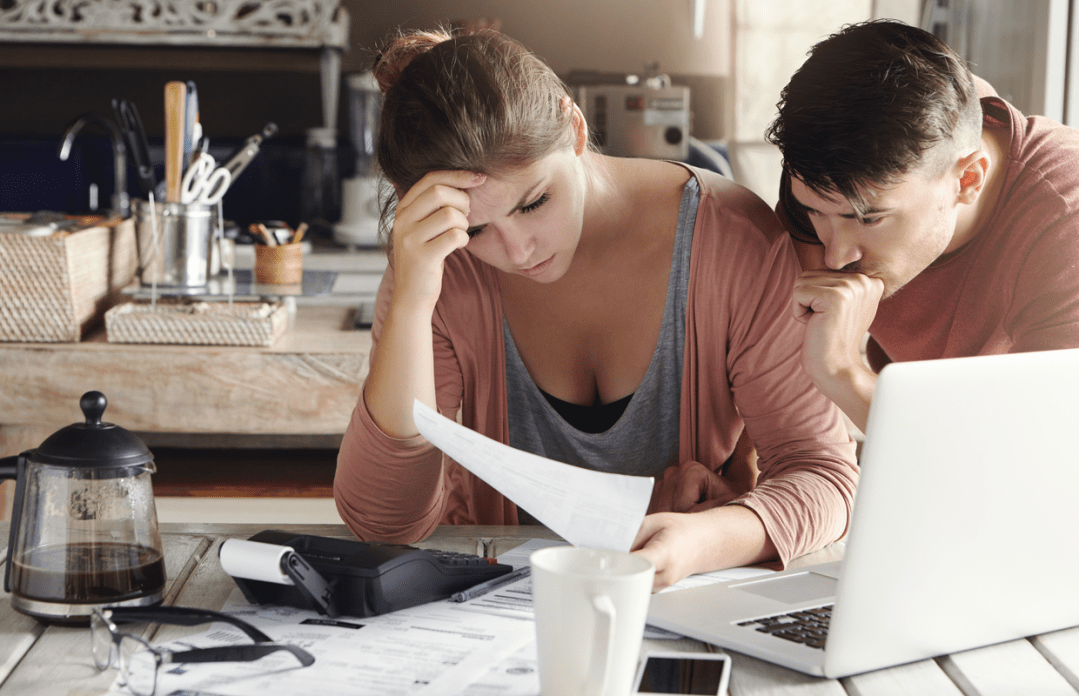

So many of us choose to put our heads in the sand rather than facing and overcoming our financial fears. But what are we really running away from? Mary Fenwick enlists the help of financial experts to discover how we can all improve our relationship with money…

What are your memories of 2008? Does it have something to do with banks collapsing, thousands losing their homes and life savings, lots of confusing and frightening headlines about sub-prime mortgages, the Lehman Brothers, and the start of the biggest global recession in 80 years?

Thought so. For me, however, none of that really penetrated. My own world was in meltdown because my husband, Will, died in the February of that year, and everything else paled in comparison. But the world doesn’t stop because you’re grieving. On the day of his funeral, I found out that the magazine I’d been editing had collapsed (like so many other businesses during that recession). I was in trouble.

Everything to do with his estate was complicated, not least because it was a second marriage for both of us. It took 18 months before the lawyers released any money. In the meantime, I had four children to think about at three different schools, no job, and a huge business tax bill.

Facing your financial fears head-on

Looking back, I’d been a bit la-la-la, fingers-in-my-ears about our finances. I’d been a high earner previously, and Will was earning well before he died. We’d talked about how it might be fun to rebalance; maybe he’d cut back a bit, and I’d do a bit more. But that hadn’t quite happened yet, and I felt guilty for falling into such a clichéd female trap of taking my eye off the ball about money.

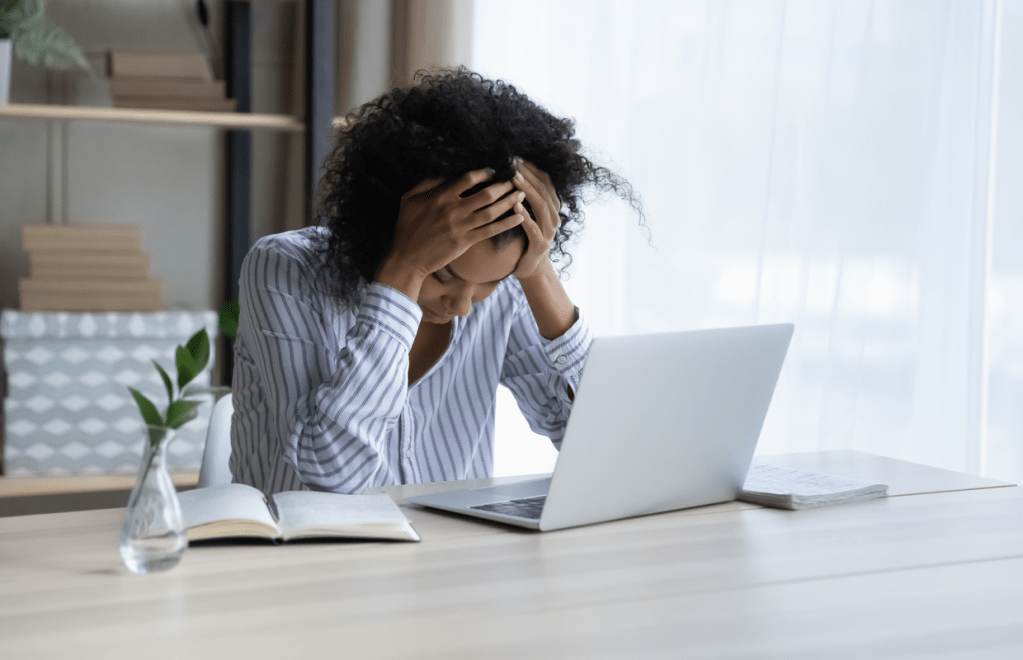

I found it humiliating to talk openly about the whole awful picture. It took me a long time to acknowledge the basic fact that, while we still lived in a nice house (hard to sell in a recession), my children now qualified for free school meals.

Consider your categories:

I now fitted into several categories that made me statistically likely to be worse off: I was a widow, a single parent, a freelance worker, and an immigrant (I’m originally from New Zealand). But I am also white, a home-owner and solidly middle class. I was able to use credit cards and borrow from friends.

But even with all that advantage, there are ways in which I’m still paying the price, 14 years later, for decisions I made back then. It’s fair to say I’ve thought a lot about money in the years since: not so much the nuts and bolts of it, but the emotions and meaning we attach to it. What are the lessons we want to pass on to our children?

Seek help for your financial fears

I set off on a mission to find out what might have helped me with overcoming my financial fears when I was at my lowest: speaking to a financial advisor who is also a coach; a women’s wealth advisor; and a charity that helps pick up the pieces when debt drives people to lose all hope.

Mary Hemingway was a financial advisor for 10 years before she trained as a coach. One of the reasons for her change was that she realised the main barrier to feeling financially comfortable is frequently our relationship with money, not the financial plan itself.

‘Money underpins the health choices that we can make, where we live, what jobs and situations we stay in, and how much abuse we’re willing to put up with in a relationship or a job,’ she explains. ‘It influences our friends, the clothes that we wear, how we feel about ourselves. We’re not really making decisions about money. It’s about our security, our freedom, our future.’

Overcoming financial fears when dealing with trauma

Mary points out that when you are dealing with trauma, it’s even harder to face. ‘It’s so much easier to just stop, and not go near it. Your brain is on high alert to avoid any more rubbish. Neurologically, you’re not able to make a coherent decision.’

This resonated for me; I had a feeling of ‘I used to be better at this’. But all the knowledge and experience in the world doesn’t help when things really hit the fan.

Wealth advisor Merel Kriegsman says, in her case, a privileged artistic background had insulated her. ‘I was raised like a character in a Jane Austen novel. I literally embroidered cushions. I can ride horses, dance, speak multiple languages and was a professional opera singer. But I was so afraid of money that I’d start wildly hyperventilating when my husband wanted to talk about our budget.’

Breaking the stereotypes around women and finances

Everyone I spoke to agreed that it takes a lot of effort and courage to overcome fears around money. Often, for women, it’s the desire to create a better role model for our children, especially daughters, that sparks us to take control.

When pregnant with her first child, Kriegsman decided, ‘When people tell you it runs in the family, you have the choice of saying it runs out right now.’ She chose to no longer have a victim mentality around finances, and face up to the situation. And doing this, she points out, doesn’t need to come with some form of public humiliation.

Stop feeling ashamed about money

What I love here is the recognition that piling on further shame just doesn’t work. The person who is struggling with money is already feeling crushed, and what they need is kindness. Kriegsman adds:

‘You don’t have to make some public declaration of your struggles if that’s really tender,’ which reminds me of the beautiful line from the poem Wild Geese by Mary Oliver: ‘You do not have to walk on your knees for a hundred miles through the desert repenting’.

I heard this language about love and forgiveness from the charity Christians Against Poverty (CAP). It is explicit about not forcing its own beliefs on anyone; Money Saving Expert Martin Lewis calls its work ‘unsurpassed when it comes to debt help’.

How to improve your relationship with money

CAP spokesperson Lorraine Papaioannou says: ‘We want to show practical love to the whole person. We don’t just take debt away and leave the person still stuck in that situation, which might be abusive or isolated.’

CAP allocates two supporters to each client, not only a debt advisor but also a befriender. ‘We say, because they’ve taken that first step, which took so much courage, they have asked hope to walk in the door. What we are now going to do is walk the rest of the journey with them; we’re going to hold their hand. We’re also going to provide practical solutions.’

CAP finds that the root of financial difficulty is often connected to holding on to difficulties from the past and feeling unable to forgive, perhaps from something as early as childhood. Papaioannou says the charity advises clients to release themselves from the burden of holding on to lack of forgiveness.

How to spend less money

In the end – after the emotional and psychological work has been done – we do need to take practical steps, however. Financial stability all comes down to a simple equation: either spend less or earn more. The quickest way is usually to cut expenses.

Ouch. Cutting feels like punishment, right? But Kriegsman suggests this reframe, from Kate Northrup’s book Money: A Love Story (Hay House, £14.99): ‘What if the most loving thing to do is spend less than you make? Cutting expenses can be an act of true love because it moves you towards greater integrity. It’s hard to have conversations with other people if you haven’t got your own act together.’

She suggests an initial aim of reducing outgoings by 20 per cent. Speaking personally, I know that I could not have faced this at the time without help. I was fortunate to have so much support, from too many people to list. But the danger is that debt and shame can quickly spiral into isolation.

If this is you now, my desire for you is to know that you are not alone, however it may feel, and that good people stand ready to help you, with love and compassion. If the last person that you spoke to was not understanding, I hope you will have the courage to try again, perhaps using some of the resources here.

Spend, save, invest and give

And, remember: getting your own house in order means that you have the capacity to give to others. Hemingway teaches her daughter to think in terms of four pots of money: spend, save, invest and give.

Spending is immediate and necessary; saving is for the slightly more long-term; investment for women is a whole other topic, but you can start as small as you like; and giving is where you can make a difference to another person.

If we are fortunate enough to live a long life, we all get a chance to make that difference. Isn’t that worth facing your own fears for?